When was the last time you got an incorrect quote or invoice? If you can’t recall, you may have a CPQ system to thank.

When was the last time you got an incorrect quote or invoice? If you can’t recall, you may have a CPQ system to thank.

Wading through the Cloud Expo at Dreamforce last month, I was struck by the amazing growth of configure-price-quote solutions among exhibitors. There seemed to be dozens of them. And they had the best spots on the floor, with the largest booths and biggest giveaways.

I had heard of CPQ, but hadn’t realized it had become such a major part of the CRM ecosystem. CPQ has exploded onto the scene. And the reason was obvious from talking to these vendors: Companies that adopt CPQ can gain a major boost in sales effectiveness. CPQ has gone from competitive advantage to competitive necessity – in no time at all.

But I couldn’t figure out what set these different companies apart. A lot of vendors offered CPQ. Why would I choose one over another? So I set out to discover what differentiated the major CPQ solutions from each other.

Methodology

The first thing I discovered is that there are a lot of CPQ players. Like the markets for many other three-letter-acronym business software tools, the CPQ market is highly fragmented.

So I limited my research to the most visible providers, those that appeared on the first page of a Google search for “CPQ” or “configure price quote”. I searched between October 1 and October 15, 2015, from an IP address in California, and found 18 vendors. (If you work in CPQ and don’t see your company on the list, it’s time to call in your SEO/SEM specialist.)

I evaluated the companies based on their websites and recorded basic information about how they sold, who they sold to, and what they cost. I also judged what their major points of difference were from one another – as that was just the thing I could not figure out from the trade show.

In particular, I tried to find a single brand message (positioning statement) that each provider used for its CPQ solution. I also identified 1-3 differentiators, either features or selling points, that a vendor considered to be unique. Sometimes this information was displayed front-page center, and other times it was buried in a white paper. I made my best judgment of what set each company apart.

Survey Results

The raw results are below.

A few statistics sum up the findings:

- Of the 18 companies, 8 serve large enterprises, 14 serve midmarket customers, and 6 serve the SMB market (definitions of these categories). Most companies serve more than one category. One company provided no information on its customers, perhaps because it is too new.

- Fourteen companies publicize the ability to integrate with Salesforce, and 5 have a native Salesforce product. No other CRM provider comes close to this level of popularity. With custom effort – available directly from most vendors – most CPQ systems can be plugged into most CRM and ERP systems.

- Just 5 companies list pricing publicly. Three use a named-user pricing model, one uses a concurrent user model, and one charges for software and user licenses.

- Twelve companies offer a SaaS option and 7 offer an on-premise option. The SaaS companies tend to offer only this delivery option (10 of 12), while every on-premise company also offers a hosted (6 of 7) or SaaS (1 of 7) option.

- The greatest number of companies specialize in manufacturing and distribution customers, reflecting the complexity of quoting in these industries.

So which one’s the best? I couldn’t tell you (and if you ask their customers, they’re probably all great – and far better than nothing). I was mostly interested in the positioning.

A Common Core

Based on features and core messaging, most of the companies are hard to distinguish from each other. The presentations these companies make show CPQ is an emerging category, one that tech majors believe will be a necessary part of every organization’s arsenal of tools. Yet a close examination shows that the market participants have already staked positions as market leaders, up-and-comers, and niche players.

Business software is not an area where bold product choices are likely to be rewarded, and CPQ is no exception. Virtually all CPQ products offer a core set of features, described in slightly different ways and with different emphases. They are:

- Ability to load in a product catalog and pricing tiers

- Rules and constraints to prevent “illegal” combinations of products, pricing, and shipping options

- Selling optimization (“guided selling”) tools alerting reps to the best options for upselling, or to meet other company goals such as profitability

- Automatic proposal and quote generation

- Integration to CRM, analytics, and sales history

- Capability to run on mobile devices and tablets.

With these features fully implemented, CPQ users see benefits in faster quote generation, less administrative time for reps, fewer quoting errors, greater sales conversion, and ultimately greater topline and bottom-line results. Most of the brand messages sell these benefits (“quote faster”, e.g.) rather than a competitive pitch.

It’s clear that CPQ providers see their main challenge as lack of awareness, not competing companies. A large share of promotional material is designed to educate potential buyers on the value of CPQ generally. No case study I examined described a competitive switch. These findings are characteristic of an emerging category: CPQ has plenty of room to grow.

Yet the crowd of players at Dreamforce suggests increased heat in this market, and perhaps a pending turn to more aggressive messaging. How are the providers setting themselves apart today, and how will this change as the market matures?

Leaders and Upstarts

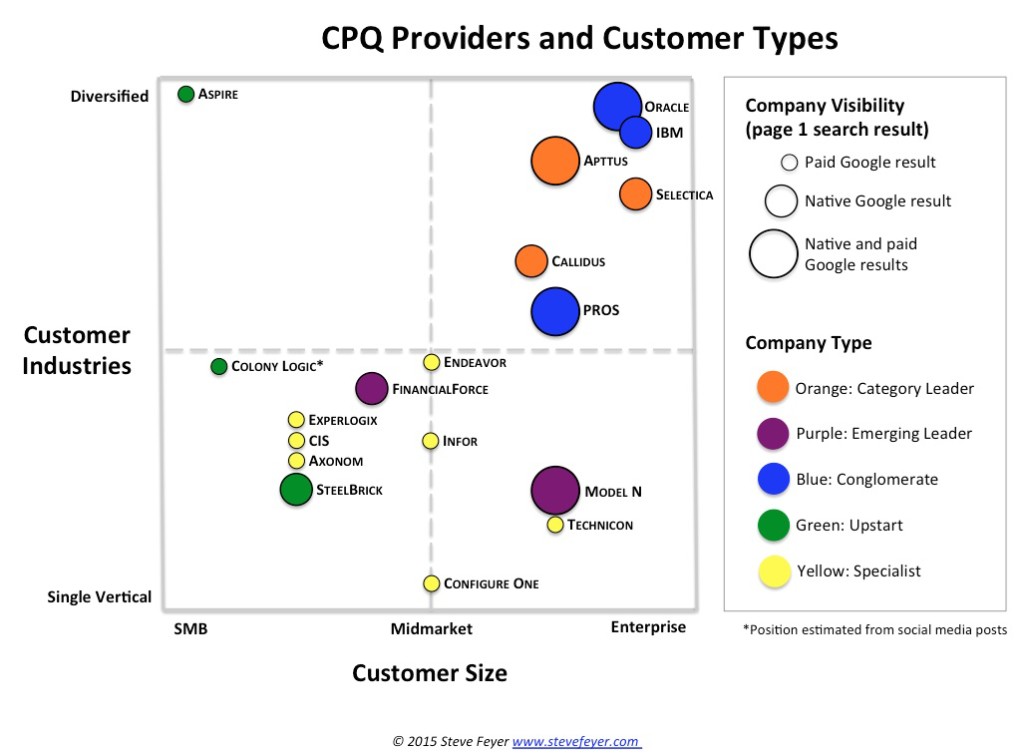

Looking at each company’s positioning and its customer base, I divide the companies into five groups. They are charted in the quadrants below.

The five groups display some specific characteristics.

- Category Leaders. These providers serve a diversified base of large customers. Their positioning focuses heavily on education and emphasizes their expertise in the CPQ category across multiple industries. These players feel that their job is to educate as many potential customers as possible about the value of CPQ – once informed, those customers are likely to pick them. They do not worry about providing exhaustive feature lists, at least initially.

- Emerging Leaders. These vendors also serve large and diversifying customer bases. They have entered the CPQ market through single verticals, and are now branching out into other industries. They are focused on benefits, less on features.

- Conglomerates. These 800-pound gorillas entered the market through acquisition (Oracle: BigMachines, 2013; PROS: Cameleon, 2013; IBM: Sterling Commerce, 2010), judging that CPQ would become a necessary product offering from any full-line provider of business software. They make the least effort to educate buyers or list features, probably judging that their massive installed customer bases will come to them first for CPQ. Perhaps for this reason, they are also generally comfortable showing list prices – the highest seen in the survey.

- Upstarts. These providers are scrapping for growth and attention using bold statements and attention-grabbing website designs. They are smaller and typically newer than the leaders. They are the only vendors that set themselves up in competitive opposition to other players, claiming better approaches and greater benefits. In particular these companies say their systems will be up and running faster. These plucky companies back up their claims with published pricing and generally list more integrations.

- Specialists. These businesses focus on customers in specific industries, mostly manufacturing-related. They provide substantial detail on features, benefits, and integrations, and usually highlight features unique to their verticals. Perhaps focused on direct marketing, these providers have the least developed brand messages.

There are other important points of difference between these CPQ products. Several are Salesforce native, but only Experlogix says it is native to Microsoft Dynamics and Netsuite. Just Model N and Technicon specialize in SAP integration. If your company is not ready for the cloud, your options for on-premise deployment are limited. And if you really require a small footprint, just Aspire’s CPQ system is desktop-installed. (It’s important to note again that there are many other CPQ providers – they just didn’t make the survey.)

To truly evaluate the subtle differences between these CPQs, you’ll need to see demos of the software and align their performance against your requirements. The information the companies provide is rather undifferentiated. Yet the different profiles of the companies mean that you can limit your evaluation to perhaps 3-5 providers based on your needs (SaaS vs. hosted or on-premise, your CRM incumbent, your industry, ease of install vs. customization, etc.) The positions the companies have staked out can inform you to a great extent.

The Future of CPQ

Up to now, CPQ has been an emerging category. This is about to change.

Why? The messaging of the Upstarts suggests an imminent switch from “green field” selling to displacement as CPQ becomes established in more firms. Conglomerates acquire CPQ providers to protect their full lines. Potential customers, seeing the Category Leaders and Emerging Leaders vie for attention at a huge show like Dreamforce, cannot help but become aware of the potential value of CPQ.

This transition point for the CPQ market illustrates the Red Queen Effect, an idea transplanted from evolutionary biology to business. The theory holds that businesses must adapt merely to keep up with their competitors. Now that many B2B firms have adopted CPQ, the laggards will soon be at such a disadvantage without it they’ll have no choice but start using CPQ or fail.

The CPQ providers will also have to adapt their marketing strategies to a more mature market.

- Companies serving diversified customers must demonstrate greater understanding of the unique needs of each industry served, and tailor messaging to verticals. Explaining the general value of CPQ will no longer be enough – because customers accept it.

- Providers will describe the unique long-term advantages they can provide, distinguishing themselves more from their main competitors. Conversion efforts can switch from benefits, which are understood, to features and competitive differentiation.

- Messaging may begin to include explicit competitive traps.

- Messages designed to reach new prospects will switch focus from introducing the need for CPQ to introducing the CPQ provider as the best choice.

- In the face of displacement campaigns from competitors, providers will increase emphasis on customer success operations. This may particularly affect smaller vendors that historically invest less in retention operations outside of sales and marketing.

The CPQ market is reaching its teenage years – literally, for many of the main providers. An adolescent market is growing into maturity, and every B2B business will soon need a CPQ system, or suffer the consequences.

10/19/15 update: As of today, Selectica has announced a new company name, Determine.

IMAGE ATTRIBUTIONS

Another beautiful Dreamforce day is on! by Celine Nadeau CC BY 2.0